Retirement Plan Services

Become an employer of choice with a retirement plan tailored to fit your organization's overall benefits program, combining world‐class open architecture investment options with local, personal service and effortless administration.

Attract and retain the best talent

Your organization's retirement plan is key to a comprehensive employee benefits program. It should help you attract and retain quality employees without requiring all of your time and energy to administer.

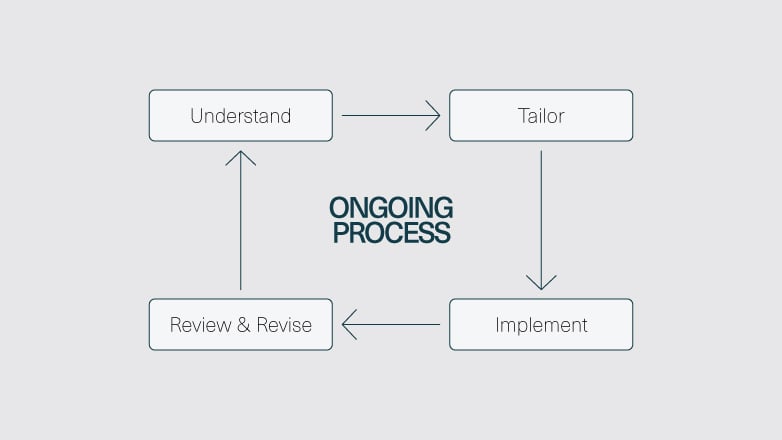

Our advisors will work closely with you to understand the unique needs of your organization and tailor a comprehensive retirement plan program that fits your overall employee benefits strategy. Our team then delivers and services your program to ensure accountability.

How We Can Help

Managed Portfolios for Plan Participants

-

Investing can be scary for plan participants and can create anxiety that keeps them from engaging with your company’s plan.

Your plan’s Target Date Retirement Funds Series is a great solution for many employees that desire a less-is-more contact approach with their retirement savings. But for those employees that have more complex finances, defined goals, and specific investment strategies, our team can help.

We are now offering professionally managed portfolios as investment options for your employees at no additional cost to the Plan. Click here to learn more.

Defined Contribution Plans

-

Your employees may set aside pre‐tax or Roth dollars in their retirement account to be invested in funds chosen by you with our professional guidance. Contributions and earnings grow tax‐deferred.

- 401(k) retirement plans for employees

- 403(b) retirement plans for employees of public entities and nonprofit organizations

- Profit-sharing plans

Facilitation of Administrative Services & Recordkeeping

-

Our integrated professional administrative team streamlines the day-to-day operations of the plan, saving you significant time and energy while providing you with the personal attention you deserve.

- Plan design consulting

- Plan sponsor service, investment and fiduciary reviews

- Online plan participant and sponsor solutions

- Participant education promoting retirement readiness

- Enhanced reporting and communication

- Participant accounting flexibility

- Comprehensive compliance testing

- Government reporting

Employee Communications

-

Communicating with your employees about retirement planning can increase participation, deferral rates and appreciation for the benefit you're providing. Educated employees make better saving and investing decisions, increasing their retirement readiness and long-term happiness.

To keep your employees engaged, we use a variety of touchpoints.

- In-person group meetings and one-on-one discussions

- Electronic communications and behavioral outreach campaigns

- Robust online planning and projection tools

Our Communication Approach

We take a holistic approach to delivering communications and education through customized group and one-to-one meetings while employing campaigns to target participant behaviors. Our advisors partner with you to ensure your organization's needs are met in the following areas.

At Plan Eligibility

Our advisors will create a smooth enrollment process for your employees by providing:

- Tailored orientation packets and outline, interactive enrollment solutions

- A retirement needs assessment

- Savings and investment allocation guidance

Goal Setting & Income Projections

We'll work side by side with you and your organization to ensure your employees are on a better path to retirement by providing:

- Interactive online financial planning tools that go beyond retirement planning to engage users in a holistic approach to achieve long-term financial security

- A personal retirement income projection assessment tool

- Guidance and financial planning consultation

Ongoing Education & Communication

We'll design an approach based on your ongoing education and communication needs, considering demographics utilizing the following services:

- Interactive online resources for plan enrollment, education, and targeted outreach campaigns

- Quarterly performance updates

- Periodic education meetings (group and/or one-on-one)

- Participant call center

- Participant web-based tools

Plan Sponsor Education

Our team will align your organization's retirement plan with your strategic priorities through:

- Fiduciary education

- Regulatory updates

- Plan design consulting

Plan Participant Resources

As an important part of your company’s benefits package for employees, it’s critical that you have a partner to help with employee engagement and to assist with helping employees with their long-term retirement success. Learn more our approach to your participant’s retirement plan experience and enrollment process.

LEARN MORE about retirement plan resources.

Our Investment Approach

Open Architecture

Our open architecture investment approach means that we're not tied to any proprietary funds, so you can be certain you'll receive objective advice regarding your fund offerings.

- Our fiduciary advice is available as an ERISA 3(21) Investment Advisor or an ERISA 3(38) Investment Manager.

- Our top‐rated investment fund options include domestic and international equity, fixed income and cash equivalent asset classes along with specialty funds if appropriate for your plan participants.

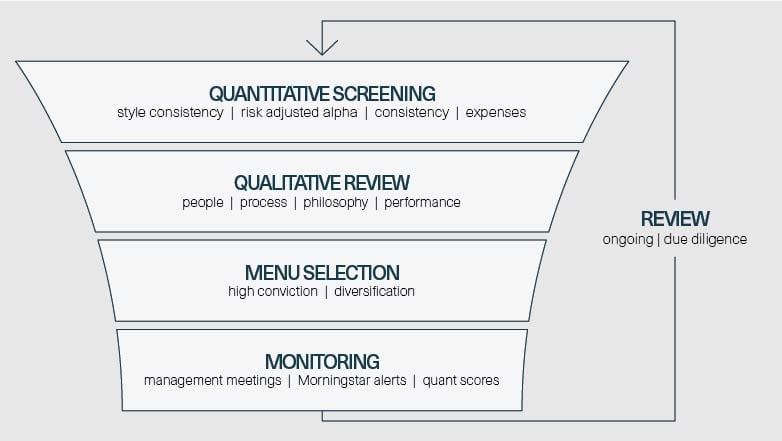

- We utilize comprehensive quantitative and qualitative screening tools and analysis in our fund selection and monitoring processes.

- Fund data is carefully analyzed to make sure funds will meet the desired investment objectives within the parameters of asset class coverage, giving participants a complete array of investment offerings.

- Funds are then reviewed on an ongoing basis to ensure investment objectives and fund expenses continue to be consistent with our analysts' expectations.

Related Resources

The Power of Narratives to Drive the Market

From the 2024 presidential election to the Taylor Swift Economy, CIO Dominic Ceci, CFA shares the current narratives that may continue to drive discussions and behaviors throughout 2024.

READ MORE about our latest investment commentary by Brian Andrew.

Running Your Business

Are you managing your business to its full potential?

LEARN MORE about running your business.The War for Talent

With low unemployment, businesses are in a battle for talent. It is a candidate's market. In addition to low unemployment, many employers are facing large numbers of baby boomers reaching retirement age. Our organization is no exception. Are you prepared?

READ MORE Click here to read more on the war for talent.Your Trusted Retirement Plan Advisor

Our advisors work hard to ensure your retirement plan is tailored to fit the needs of your organization's overall benefit program.

FIND AN ADVISOR